Looking for Kent Reliance business banking? Kent Reliance markets itself as “a national bank with a local feel.” As you may have gathered from the name, the physical presence of this financial body is limited to the county of Kent. Anybody from across the UK will be welcome to open a savings account, though whether you will be interested in doing so is another question.

Kent Reliance does not offer current accounts or lending streams, and just one savings account for businesses. The interest rate of 4.31% is pretty good given that you can access funds within 24 hours, but it’s hardly mind-blowing.

Featured pro tools

Unless you are trading out of Kent and wish to access branch support for your savings, there is little to recommend Kent Reliance over a national rival or online-only challenger – this provider offers considerably greater value to personal customers than businesses.

Kent Reliance business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Kent Reliance at a glance

- Other business finance products

- Kent Reliance reviews

- Kent Reliance business eligibility criteria

- Kent Reliance business finance alternatives

- Kent Reliance additional considerations

- FAQ

Pros and cons of Kent Reliance for business services

| Pros of Kent Reliance | Cons of Kent Reliance |

|---|---|

| ✓ FSCS protected | ✗ All branches are in Kent |

| ✓ 2.0% is not a bad AER for an almost instant-access savings account | ✗ No current accounts or lending streams, and only one savings account |

| ✗ No apps |

Business current accounts

✗ Kent Reliance does not offer business current accounts. See best business bank accounts.

Business overdrafts

✗ Not available through Kent Reliance. See best business overdrafts.

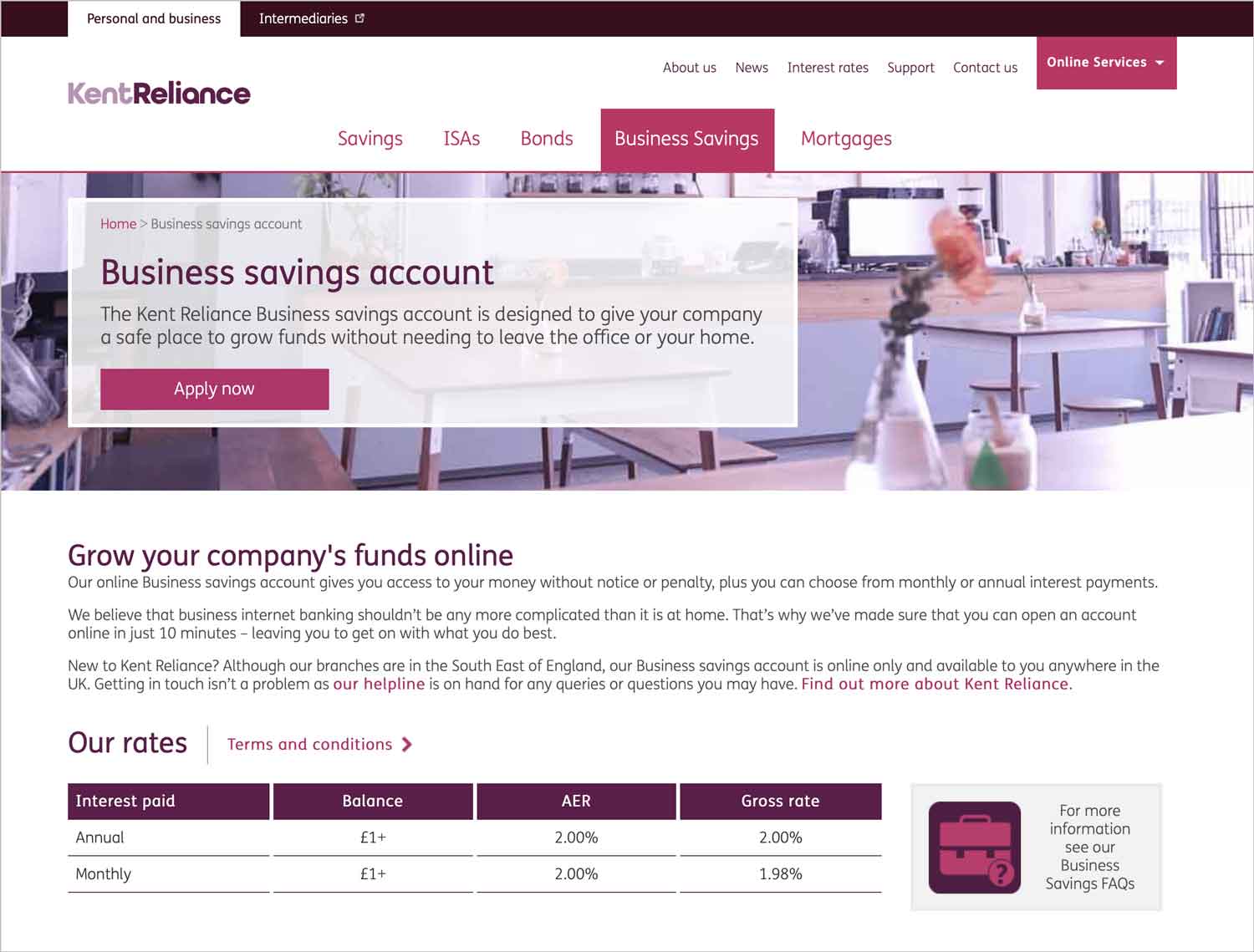

Business savings accounts

Kent Reliance offers a business savings account. The minimum opening deposit is £1,000, and the account can hold up to £1,000,000. You will have access to your funds at any time with 24 hours’ notice, and interest is paid at an AER of 4.31%. Companies must have a maximum of 3 Directors to be eligible

Kent Reliance at a glance

| Phone number | 03451 221122 |

| App downloads | N/A |

| Website | www.kentreliance.co.uk |

| Number of branches | 9, all in Kent |

| FSCS protected? | Yes |

| Founded | 1986 |

Other business finance products

✗ Kent Reliance does not provide additional services to business customers. This bank is really designed with personal consumers in mind.

Kent Reliance reviews

What are other business banking customers saying about Kent Reliance?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 3.8/5 | 2,887 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 2.2/5 | 93 |

| Which? | Not reviewed | N/A |

| Average score | 3/5 | 2,980 |

Kent Reliance business eligibility criteria

You will not need to be based in Kent to save with Kent Reliance, though the lack of apps means that you will need to conduct any business over the telephone or from a desktop computer. You’ll need to prove your identity when making an application, and make a deposit of at least £10,000 to open a savings account.

Kent Reliance business finance alternatives

If you are not based in Kent, or simply want more options attached to your business savings, consider Nationwide as a building society with a presence all over the UK, or use an online-only challenger saver like Aldermore or Allica Bank.

Kent Reliance additional considerations

We have been a little harsh on Kent Reliance, so it should be noted that personal customers will enjoy many more options through this bank. That is little comfort to a business unless you are based in Kent and wish to keep your professional and personal finances closely linked, though.

FAQ

Yes, Kent Reliance is a proper bank. It has been established as a building society in 1856 and became a full-fledged bank in the year 2000. The bank is authorised and regulated by the Prudential Regulation Authority (PRA) and subject to regulation by the Financial Conduct Authority (FCA). It also holds an active license from the Bank of England and is a member of the Financial Services Compensation Scheme (FSCS).

To open a Kent Reliance business account, you will need to fill in an online application form. Once the application has been reviewed, you will be required to provide documents such as evidence of ownership and two forms of identification. These may include proof of address, a passport or driving licence, and bank statements from another institution. After your information is verified, you will receive a welcome pack containing all the details and terms of your account. You can then start using your new business account right away.

Kent Reliance may charge a variety of fees including, but not limited to, overdraft fees and account maintenance fees. These will vary depending on the type of account you hold with the bank and what services you require.

Kent Reliance offers a wide range of services for businesses. These include business current accounts, business lending, credit cards and debit cards, corporate finance, international banking services, merchant services and more. Additionally, they offer other products such as ISAs and investment options that are tailored to meet the needs of small-to-medium sized businesses.

Kent Reliance accepts a variety of payment methods including debit cards, credit cards, direct payments and bank transfers. They are also able to process payments from Apple Pay, PayPal, Google Pay and other contactless payment systems. Additionally, they offer merchant services such as online checkout solutions and point-of-sale systems that make it easy to accept payments from customers.

Kent Reliance provides a range of customer support options for businesses. This includes phone and online support, as well as access to a team of dedicated business banking specialists who are available to assist with any queries or concerns you might have.