Mighty oaks famously grow from tiny acorns, and Acorn Account positions itself as a business banking option for companies and sole traders that may struggle to open an account elsewhere.

Important note: The Acorn Account has now closed and existing accounts have become part of Card One Money. This article has been preserved for archival reference purposes.

Featured pro tools

This provider does not run credit checks upon application for a business account, so if you have struggled in the past or are yet to build a credit profile for your business, this challenger bank – which also allows over-the-counter banking at any UK branch of Barclays Bank – could be the ideal choice.

Acorn Account business banking services

- Pros and cons of Acorn Account

- Acorn business current accounts

- Acorn business overdrafts

- Acorn business savings accounts

- Acorn Account at a glance

- Other business finance products

- Acorn Account reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Acorn Account for business services

| Pros of Acorn Account | Cons of Acorn Account |

|---|---|

| ✓ Guaranteed acceptance | ✗ £60 application fee |

| ✓ No credit checks | ✗ £12.50 monthly charge and transaction fees |

| ✓ Rapid account approval | ✗ No FSCS protection |

| ✓ Access to an account manager | ✗ No lines of credit available |

| ✗ Poor online reviews |

| What’s new with Acorn Account in December 2023? |

|---|

| Equals Group Plc, the owner of Acorn Account since 2017, has announced that it intends to move all customers over the Card One Money platform, which is also owned by the group. |

Business current accounts

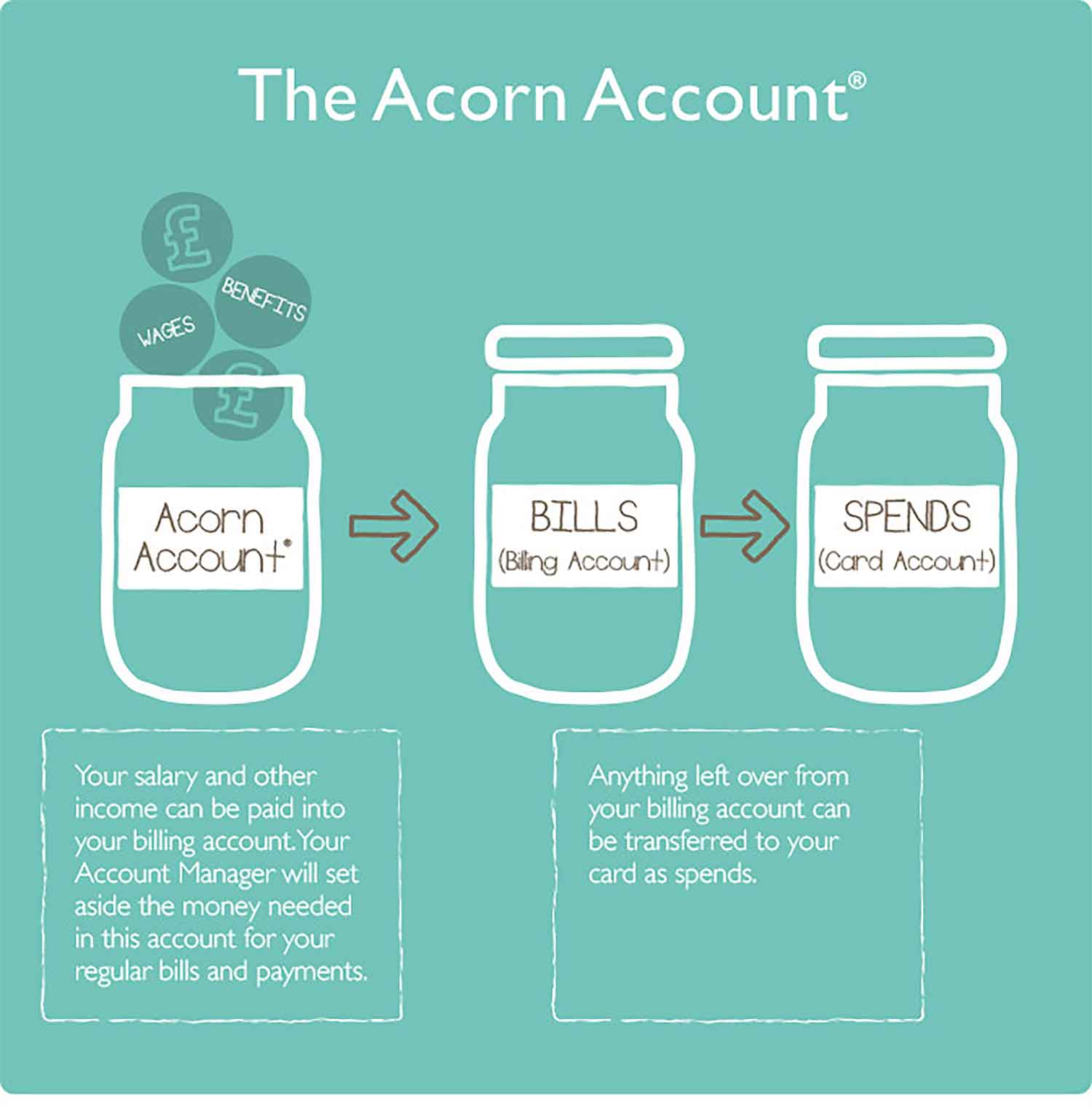

Acorn Account offers one basic business bank account, which is designed for SMEs or sole traders with an annual turnover below £2,000,000 per year. Most applications for an Acorn Account business account are approved and active within 24 hours, as long as you provide the relevant proof of identity and business documentation.

This account attracts a £60 fee, which you will need to pay upon a successful application. After this, you will be charged £12.50 per month as a monthly charge, and the following fees for all transactions you make using Acorn Account.

| Transaction type | Fee or charge |

|---|---|

| Receiving electronic payments | 30p per transaction |

| Outgoing standing order, CHAPS, or direct debit payments | 30p per transaction |

| Paying in cheques | 0.75% of cheque value (minimum 50p) |

| ATM withdrawals in the UK | £1.50 |

| ATM withdrawals overseas £3 | £3 |

| Debit card purchases overseas | £2.75 |

These fees can quickly start to pile up if you use your account regularly, so ensure that Acorn Account is the right choice for you. It is not a competitively priced product, and the limited number of online reviews are not complimentary.

The flipside of this is that no credit checks will be run on your account, meaning that anybody can apply with confidence, and you can pay cash or cheques into your Acorn Account over the counter of a branch of Barclays Bank.

Business overdrafts

✗ Not available through Acorn Account.

Business savings accounts

✗ Not available through Acorn Account.

Acorn Account at a glance

| Phone number | 0871 811 1883 |

| App downloads | iOS; Android |

| Website | https://www.acornaccount.com |

| Number of branches | 1,000+ branches of Barclays |

| FSCS protected? | No |

| Founded | 2012 |

Other business finance products

Acorn Account runs a very rudimentary service, providing a basic current account for businesses and sole traders. This provider does not offer any additional services, such as lines of credit or savings accounts. If you are a firmly established SME or sole trader, you should probably look elsewhere.

Acorn Account reviews

What are other business banking customers saying about Acorn Account?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 1.7/5 | 21 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 1/5 | 3 |

| Which? | Not reviewed | N/A |

| Average score | 1.375/5 | 24 |

Acorn Account business eligibility criteria

One of the greatest appeals of Acorn Account is that anybody can apply for a business account with this provider, even if your business has bad credit, provided your annual turnover is below £2,000,000 per year. Acorn Account guarantees approval for any business that does not contravene the law or moral standards, and will not run a credit check upon your business when you make an application.

Acorn Account business finance alternatives

Acorn Account is a fine choice if your business is new and yet to build up a credit score, or you have experienced financial issues in the past, though you will be charged accordingly for this flexibility. Take a look at Cashplus, who are equally open to businesses with substandard credit, if you would like to consider an alternative.

Acorn Account additional considerations

Like most UK banks, Barclays is closing branches all over the nation at a rate of knots. If you are considering Acorn Account thanks to the ability to bank over-the-counter, check that your local branch of Barclays will not soon be closed down.

FAQ

No, Acorn Account is not a proper bank. It provides prepaid debit cards and mobile banking services, but does not offer savings accounts or other traditional banking services like loan products that banks would typically offer. This means that customers cannot benefit from the financial protection scheme provided by the UK’s Financial Services Compensation Scheme, which applies to deposits made with authorised banks in the UK. It is important to be aware of this limitation when considering using Acorn Account services.

Opening a business account with Acorn Account is simple and can be done online. You will need to provide some information including your company name, contact details and an estimate of how much money you’ll be transacting through the account each month. After providing this information, you will complete a Know Your Customer (KYC) check which helps establish the identity of the person/business opening the account. Once complete, you’ll be able to start using your Acorn Account business account right away.

Having an Acorn Account business account can provide several benefits for small businesses and entrepreneurs. These include access to digital payment services such as card payments and contactless payments, a secure digital money account to manage your finances, the ability to issue prepaid debit cards to employees, and access to detailed analytics on your spending. In addition, because it is not a bank you can open an account quickly without having to go through traditional banking processes like credit checks.

As with any banking service, there are fees associated with the use of Acorn Account’s business accounts. These include setup fees and transaction fees for card payments, contactless payments and international payments. Depending on your account type, you may also be charged a monthly fee or an annual fee.

Acorn Account offers a range of services to small businesses and entrepreneurs. These include prepaid debit cards, mobile banking, contactless payments, digital accounting services, analytics on spending and international payments. Additionally, they offer an automated invoicing and payment service which streamlines the process of sending invoices and collecting payments.

Acorn Account accepts payments by card, contactless and international payments. The cards they accept include Visa, Mastercard, Maestro and American Express. Additionally, Acorn Account uses SEPA (Single Euro Payments Area) technology for international payments to ensure that money is transferred securely.