This research report offers an exploration of 59 of the United Kingdom’s leading towns and cities for fostering artificial intelligence (AI) enterprises. By analysing key metrics that contribute to a thriving AI ecosystem, this study identifies the most advantageous environments for AI business growth and sustainability.

The report aims to provide valuable insights for interested stakeholders, guiding them in making strategic decisions about where to establish, expand, or support AI operations within the UK. Through identifying current trends and analysis, this report highlights the dynamic landscapes shaping the future of AI business.

Featured pro tools

Who is this report for?

This report may be of interest to a variety of stakeholders, including:

- Entrepreneurs and start-up founders: Those looking to establish new AI businesses will find valuable insights into the best locations for growth and support.

- Investors and venture capitalists: Individuals and organisations seeking investment opportunities in the AI sector can use this report to identify promising regions with high potential for returns.

- Policy makers and government officials: Insights from the report can help in formulating policies and initiatives to foster AI development and attract businesses to their regions.

- Business analysts and consultants: Professionals in this field can utilise the data to provide strategic advice to their clients about market opportunities and regional advantages.

- Educational institutions and training centres: Understanding the demand for AI-related skills can help these institutions tailor their programmes to better prepare the future workforce.

- Existing AI businesses: Companies looking to expand their operations or relocate can use the report to make informed decisions about the best locations for their growth.

- Job seekers in the AI field: Individuals seeking employment in AI can identify regions with the highest job opportunities and thriving AI ecosystems.

What is an AI business and why does it matter?

An AI business is an enterprise that specialises in the development, implementation, or utilisation of artificial intelligence technologies to offer products, services, or solutions. These businesses may focus on areas such as machine learning, natural language processing, computer vision, robotics, and data analytics.

AI businesses are crucial because they drive innovation across various industries, enhancing efficiency, productivity, and decision-making processes. By automating tasks, providing advanced insights, and enabling new capabilities, AI businesses contribute significantly to economic growth, create high-skilled job opportunities, and help address complex societal challenges, ultimately shaping a more advanced and competitive future.

The results in full

- Cambridge

- Bristol

- Reading

- Lincoln

- Newcastle upon Tyne

- Southampton

- Gloucester

- Slough

- Oxford

- London

- Bournemouth

- Milton Keynes

- Chelmsford

- Warrington

- Cardiff

- Exeter

- Cheltenham

- Belfast

- Glasgow

- Manchester

- Edinburgh

- Sheffield

- Leeds

- Brighton and Hove

- Portsmouth

- Ipswich

- Aberdeen

- Luton

- York

- Swindon

- Blackburn with Darwen

- Coventry

- Middlesbrough

- Liverpool

- Peterborough

- Nottingham

- Wrexham

- Dundee

- Plymouth

- Bridgend

- Tunbridge Wells

- Bradford

- Worthing

- Swansea

- Birmingham

- Colchester

- Leicester

- Wolverhampton

- Stoke-on-Trent

- Falkirk

- Sunderland

- Gateshead

- Crawley

- Southend-on-Sea

- Norwich

- Derby

- Dumfries and Galloway

- Blackpool

- Kingston upon Hull

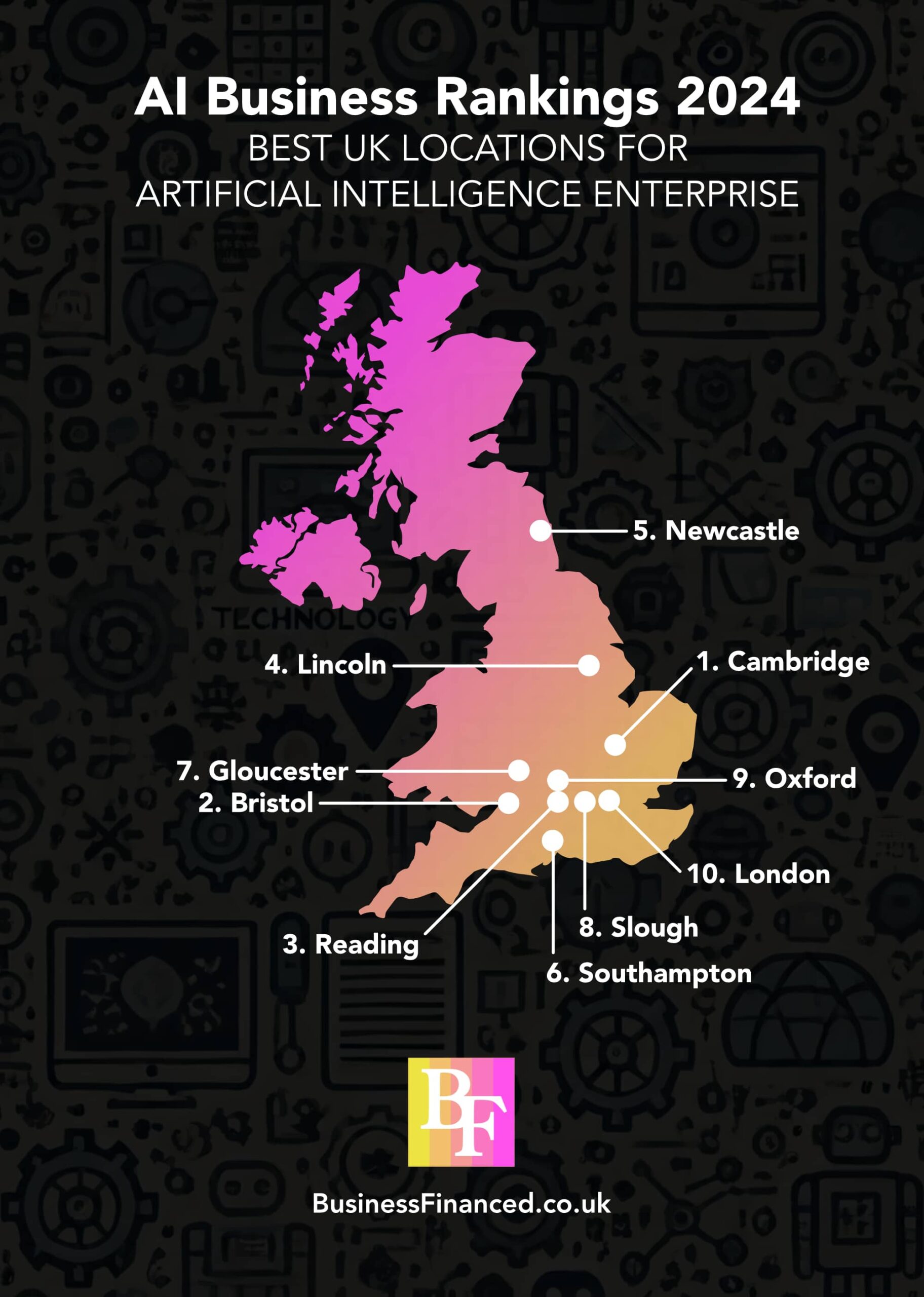

Key findings and notable results

The research reveals several key insights and notable results regarding the top cities for AI enterprises in the United Kingdom.

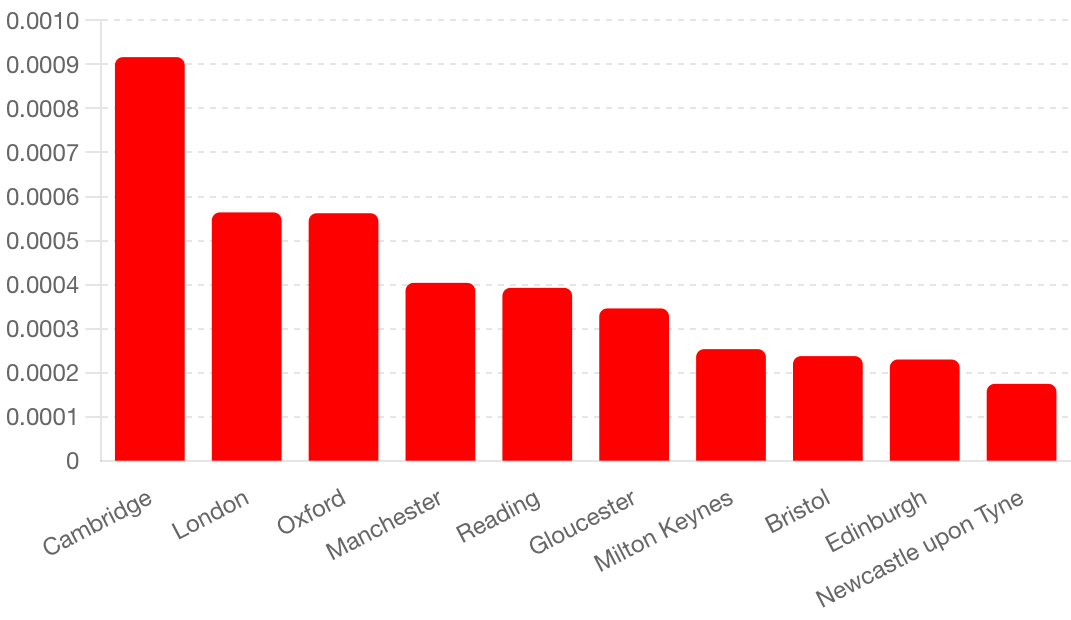

Cambridge emerges as the leading location for AI businesses, boasting the highest overall ranking. It demonstrates a strong balance across various metrics, including a substantial number of AI-related businesses (140) and a significant online search volume per person (0.1674). Additionally, Cambridge shows a promising business survival rate of 46.2%, indicating a supportive environment for long-term success.

Bristol ranks second, highlighted by an impressive online search volume per person (0.6703) and a solid count of AI-related businesses (101). Its business survival rate stands at 42.8%, reflecting a stable and encouraging atmosphere for AI enterprises.

Reading secures the third position with notable strengths in AI job vacancies per person (0.000113) and a considerable online search volume (0.3556). Despite a slightly lower business survival rate of 38.9%, Reading’s robust AI ecosystem supports its high ranking.

Other cities, such as Lincoln and Newcastle upon Tyne, show strong performances with high online search volumes and commendable business survival rates (43.8% and 41.4%, respectively). These locations, though smaller in terms of the number of AI businesses, provide fertile ground for AI innovation and growth.

London, while having the highest number of AI-related businesses (approx. 5000), ranks tenth overall due to its relatively lower AI job vacancies per person (0.000021) and a moderate business survival rate (39.2%). This highlights the competitive nature of the capital’s AI market, which, while abundant in opportunities, presents challenges in sustainability and job availability.

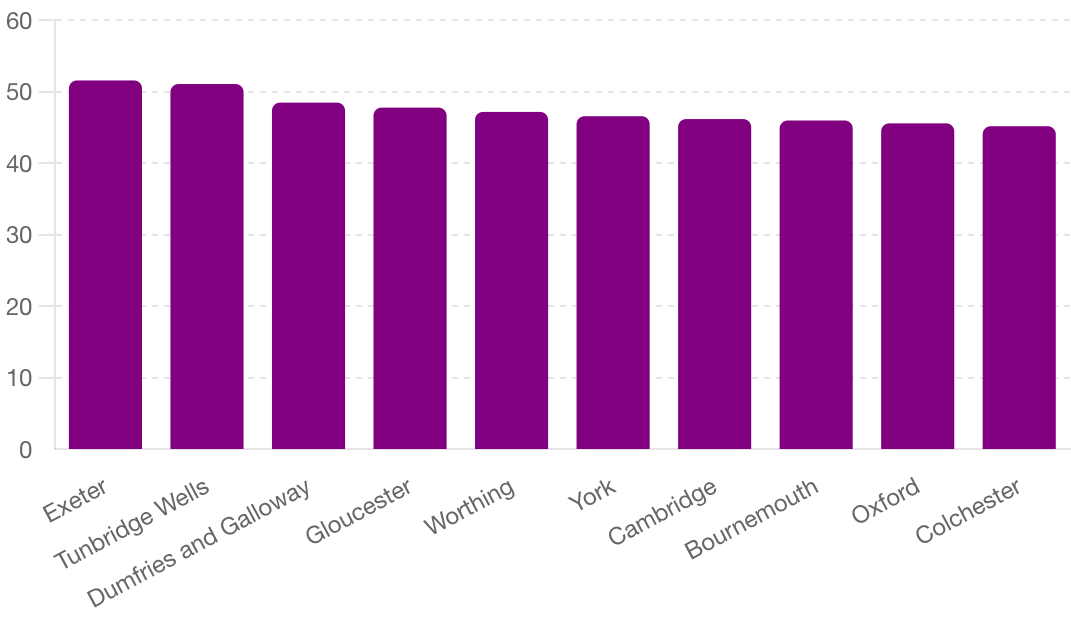

Notably, Exeter and Tunbridge Wells stand out for their exceptional business survival rates (51.6% and 51.1%, respectively), indicating very supportive environments for sustaining AI businesses over the long term.

The findings from this report highlight the diversity of strengths across various UK cities, offering valuable insights for stakeholders aiming to establish, invest in, or expand AI operations. These insights reveal not only the current hotspots for AI activity but also the emerging regions with potential for significant future growth.

Patterns and surprises

Analysis reveals several patterns and unexpected findings that offer deeper insights into the UK’s AI landscape.

Geographical distribution

A noticeable pattern is the geographical diversity of the top-ranked cities. While traditional tech hubs like Cambridge and London perform well, cities across different regions, such as Bristol in the South West and Newcastle upon Tyne in the North East, also show strong potential. This indicates that AI business opportunities are not confined to a single area but are spread throughout the UK.

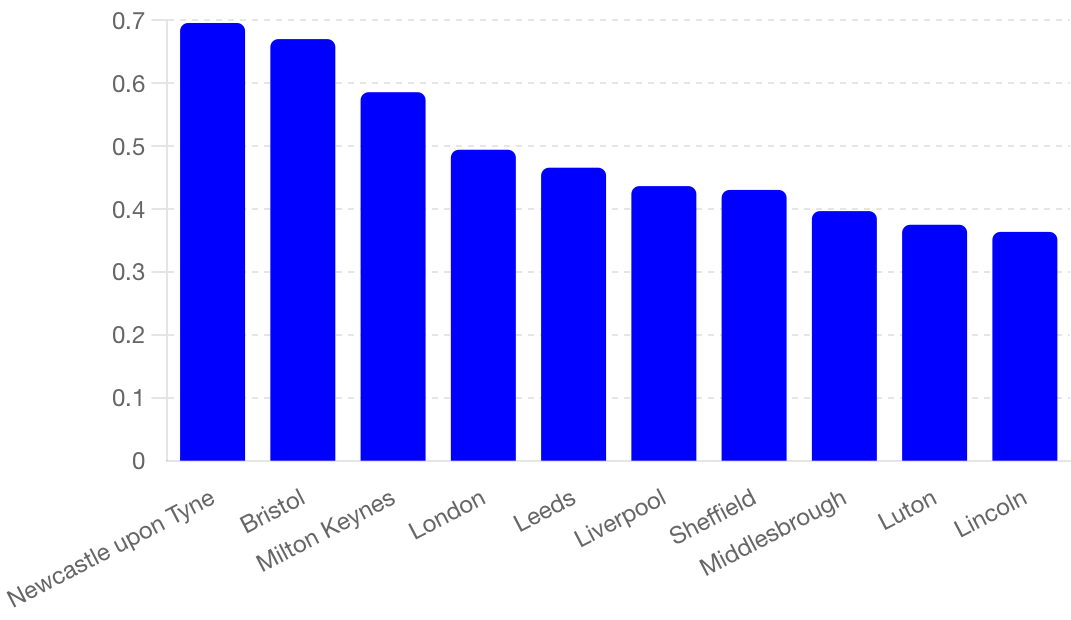

High search volumes and business density

Cities like Bristol and Newcastle upon Tyne exhibit high online search volumes for AI-related phrases, suggesting strong local interest and engagement with AI technologies. This correlates with a substantial presence of AI businesses and job opportunities, reinforcing the importance of public interest in fostering an AI-friendly environment.

Business survival rates

Unexpectedly, smaller locations like Exeter and Tunbridge Wells report some of the highest business survival rates (51.6% and 51.1%, respectively). This contrasts with larger cities where the competitive environment might pose more challenges to business longevity. These findings suggest that smaller cities can offer supportive conditions for sustained business success, likely due to less saturated markets and potentially more personalised local support.

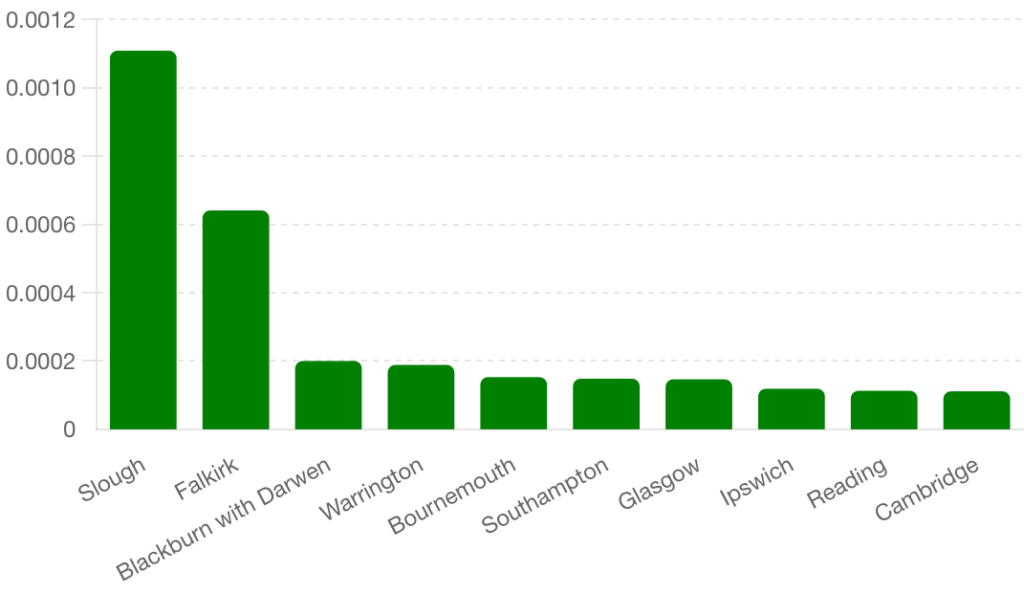

Job vacancy anomalies

Slough, despite being relatively lower in overall ranking, stands out with an exceptionally high AI job vacancy rate per person (0.001109). This anomaly suggests a high demand for AI professionals in the area, which could be attributed to the presence of specific AI-intensive industries or large organisations seeking specialised talent.

London’s mixed results

London, while having the highest number of AI-related businesses (5000), presents a lower than expected AI job vacancy rate per person (0.000021) and a moderate business survival rate (39.2%). This highlights the intense competition and saturation in the capital, making it a challenging environment for new AI ventures despite its vast opportunities.

Low job vacancy but high survival rates

Some places, such as Gloucester and Ipswich, demonstrate lower AI job vacancy rates but boast high business survival rates (47.8% and 43.4%, respectively). This suggests that while job openings may be fewer, the existing businesses are thriving, pointing to stable and supportive business environments.

Emerging cities

Locations like Lincoln and Chelmsford, although not traditionally recognised as tech hubs, are emerging as promising locations for AI businesses. Lincoln’s strong online search volume (0.3638) and Chelmsford’s solid business survival rate (44.8%) indicate growing interest and support for AI development in these areas.

These patterns and unexpected points highlight the dynamic and evolving nature of the AI business landscape in the UK. They underscore the importance of considering a range of factors when evaluating the best locations for AI enterprises, beyond just the traditional tech centres.

Responses from the experts

In this section, we present insightful comments responses from industry experts and stakeholders, providing their perspectives on the findings of the research.

University of Reading

Dr Keith Arundale, Senior Visiting Fellow at the ICMA Centre, Henley Business School, said:

“It is hardly surprising Reading has been ranked 3rd best location for AI businesses, even ahead of London. There is a vibrant ecosystem in Reading with entrepreneurially focused graduates emerging from the University of Reading and Henley Business School, the new Thames Valley Science Park at Shinfield, and many local support and networking organisations.

“There are go-ahead professional service firms, angel finance from Henley Business Angels – part of the business school – plus local Venture Capitalist (VC) firms for finance to start-up and grow with fast connections to the plethora of London based VCs.

“A new initiative is currently underway to further improve interconnectivity in the Reading Tech Ecosystem – the Reading Tech Cluster steering group – with leading representatives from the community, so we would expect Reading to move even further up the league tables.”

Ranking criteria and methodology

This report uses specific criteria to evaluate and rank the most favourable locations for AI enterprises. These criteria are essential for understanding the potential success of AI businesses in different regions.

- Number of AI-related job vacancies: This metric indicates the demand for AI talent and the availability of opportunities for professionals in the field. A higher number of job vacancies suggests a thriving AI industry and a robust market for AI skills.

- Number of AI-related businesses: The presence of numerous AI businesses in a region reflects a supportive ecosystem and a vibrant industry. It indicates strong networks, collaboration opportunities, and a competitive environment that can drive innovation.

- Online search volume for AI-related phrases: This criterion helps gauge public interest and awareness of AI technologies in a region. High search volumes suggest a community that is engaged with AI, indicating potential markets for AI products and services.

- 5-year business survival rate: The survival rate of businesses over five years measures the stability and sustainability of enterprises in a region. Higher survival rates imply a favourable business environment, supportive infrastructure, and resources that contribute to the long-term success of AI businesses.

The first four of these criteria were scored per person, using the population number for the location, so that smaller towns and cities were not unfairly penalised for having a lower number of inhabitants.

We included all UK towns and cities with a population of 100,000 or more, and where the necessary data was available, and this resulted in 59 locations being included in the rankings.

These criteria collectively provide a comprehensive view of the conditions necessary for AI business success, helping stakeholders make informed decisions about where to invest, establish, or expand AI operations in the UK.

Full data set

← Table scrolls horizontally on smaller screens →

| Rank | Location | Online search volume per person | AI job vacancies per person | AI businesses | Business survival rate |

|---|---|---|---|---|---|

| 1 | Cambridge | 0.1674021213 | 0.0001113002488 | 140 | 46.2 |

| 2 | Bristol | 0.6702656303 | 0.000035276272 | 101 | 42.8 |

| 3 | Reading | 0.355631885 | 0.0001128585098 | 80 | 38.9 |

| 4 | Lincoln | 0.3637702645 | 0.0000382573765 | 13 | 43.8 |

| 5 | Newcastle upon Tyne | 0.6958927543 | 0.00002443750109 | 50 | 41.4 |

| 6 | Southampton | 0.3359185963 | 0.0001482253025 | 31 | 40.1 |

| 7 | Gloucester | 0.030196955 | 0.00006747922905 | 41 | 47.8 |

| 8 | Slough | 0.2845105031 | 0.001108747116 | 20 | 38.2 |

| 9 | Oxford | 0.02225930154 | 0.00008196481368 | 96 | 45.6 |

| 10 | London | 0.4943595776 | 0.00002064023063 | 5000 | 39.2 |

| 11 | Bournemouth | 0.08649309002 | 0.0001527067267 | 9 | 46 |

| 12 | Milton Keynes | 0.5858467619 | 0.00005574136009 | 50 | 34.7 |

| 13 | Chelmsford | 0.3596384181 | 0.00001807909605 | 13 | 44.8 |

| 14 | Warrington | 0.07931073898 | 0.0001886037606 | 19 | 40.2 |

| 15 | Cardiff | 0.1805051063 | 0.00003864200938 | 54 | 40.3 |

| 16 | Exeter | 0.0480760848 | 0.00001585100059 | 18 | 51.6 |

| 17 | Cheltenham | 0.04257374504 | 0.00006900120752 | 13 | 43.4 |

| 18 | Belfast | 0.07977291282 | 0.000008685129322 | 53 | 44.8 |

| 19 | Glasgow | 0.06297229219 | 0.0001464105793 | 96 | 37.7 |

| 20 | Manchester | 0.2183225093 | 0.00006377483233 | 190 | 25.9 |

| 21 | Edinburgh | 0.06603035311 | 0.00001899443463 | 121 | 42.1 |

| 22 | Sheffield | 0.4304873785 | 0.000005993586862 | 53 | 43.2 |

| 23 | Leeds | 0.4658312822 | 0.000005594092638 | 53 | 42.9 |

| 24 | Brighton and Hove | 0.3052705653 | 0.000003608740369 | 46 | 41.8 |

| 25 | Portsmouth | 0.3630729272 | 0.00003134726047 | 11 | 40.1 |

| 26 | Ipswich | 0.02256457625 | 0.0001187609277 | 9 | 43.4 |

| 27 | Aberdeen | 0.07482730606 | 0.000004488471361 | 38 | 42.5 |

| 28 | Luton | 0.375103308 | 0.0000642329515 | 13 | 30.7 |

| 29 | York | 0.03740692381 | 0.00001411582031 | 12 | 46.6 |

| 30 | Swindon | 0.06041485192 | 0.00004355400697 | 12 | 39.8 |

| 31 | Blackburn with Darwen | 0.0660877916 | 0.0002000720259 | 5 | 34.5 |

| 32 | Coventry | 0.1014740694 | 0.00002323656273 | 36 | 37.3 |

| 33 | Middlesbrough | 0.3967951962 | 0.000006746955436 | 7 | 40.8 |

| 34 | Liverpool | 0.4365500972 | 0.0000157926426 | 44 | 26.4 |

| 35 | Peterborough | 0.0546837701 | 0.00008394323339 | 7 | 38.2 |

| 36 | Nottingham | 0.03691250542 | 0.000006671336602 | 51 | 40.4 |

| 37 | Wrexham | 0.05729089563 | 0.0000222057735 | 2 | 44.6 |

| 38 | Dundee | 0.03979826699 | 0.0000676956404 | 8 | 37.5 |

| 39 | Plymouth | 0.05820831226 | 0.000007491899384 | 6 | 45.1 |

| 40 | Bridgend | 0.02362825789 | 0.00009602194787 | 2 | 42.7 |

| 41 | Tunbridge Wells | 0.01980052038 | 0.000008673026886 | 4 | 51.1 |

| 42 | Bradford | 0.04587213655 | 0.000008983380746 | 6 | 43.3 |

| 43 | Worthing | 0.03467120588 | 0.000008958967927 | 1 | 47.2 |

| 44 | Swansea | 0.08159875232 | 0 | 12 | 42.5 |

| 45 | Birmingham | 0.1212163638 | 0.000006242336417 | 97 | 32.1 |

| 46 | Colchester | 0.03500326308 | 0 | 7 | 45.2 |

| 47 | Leicester | 0.2696345123 | 0.000007378621673 | 20 | 34.4 |

| 48 | Wolverhampton | 0.09648541822 | 0.00002991133426 | 5 | 31.8 |

| 49 | Stoke-on-Trent | 0.02613985263 | 0.00002686521339 | 3 | 41.5 |

| 50 | Falkirk | 0.0174735532 | 0.0006409458619 | 1 | 35.8 |

| 51 | Sunderland | 0.02562457297 | 0.00004158868788 | 6 | 36.3 |

| 52 | Gateshead | 0.005161346287 | 0.00006072172103 | 7 | 31.3 |

| 53 | Crawley | 0.02843633347 | 0.00003318125259 | 4 | 37.6 |

| 54 | Southend-on-Sea | 0.04381668084 | 0 | 3 | 43.6 |

| 55 | Norwich | 0.04741744285 | 0.000004980823828 | 20 | 24.7 |

| 56 | Derby | 0.009039281502 | 0.000003628776195 | 18 | 39 |

| 57 | Dumfries and Galloway | 0.005605215404 | 0 | 0 | 48.5 |

| 58 | Blackpool | 0.03354799759 | 0.00002683303146 | 2 | 33.3 |

| 59 | Kingston upon Hull | 0.01017318415 | 0 | 9 | 39.4 |

Sources

- ONS data

- Census data

- Google Keyword Planner

- Indeed.com