Not to be confused with the Royal Bank of Scotland, which is an entirely separate entity, the Bank of Scotland is today part of the Lloyds Banking Group and remains the national financial institute for SMEs and sole traders based north of the border. But is Bank of Scotland business banking a good choice?

The bank has 130 branches in Scotland, but the services provided are virtually identical to Lloyds Bank, so anybody based in England, Wales, or Northern Ireland is better off banking with the parent company. Whichever of these options you take, a raft of account options and lending streams will be available to you.

Featured pro tools

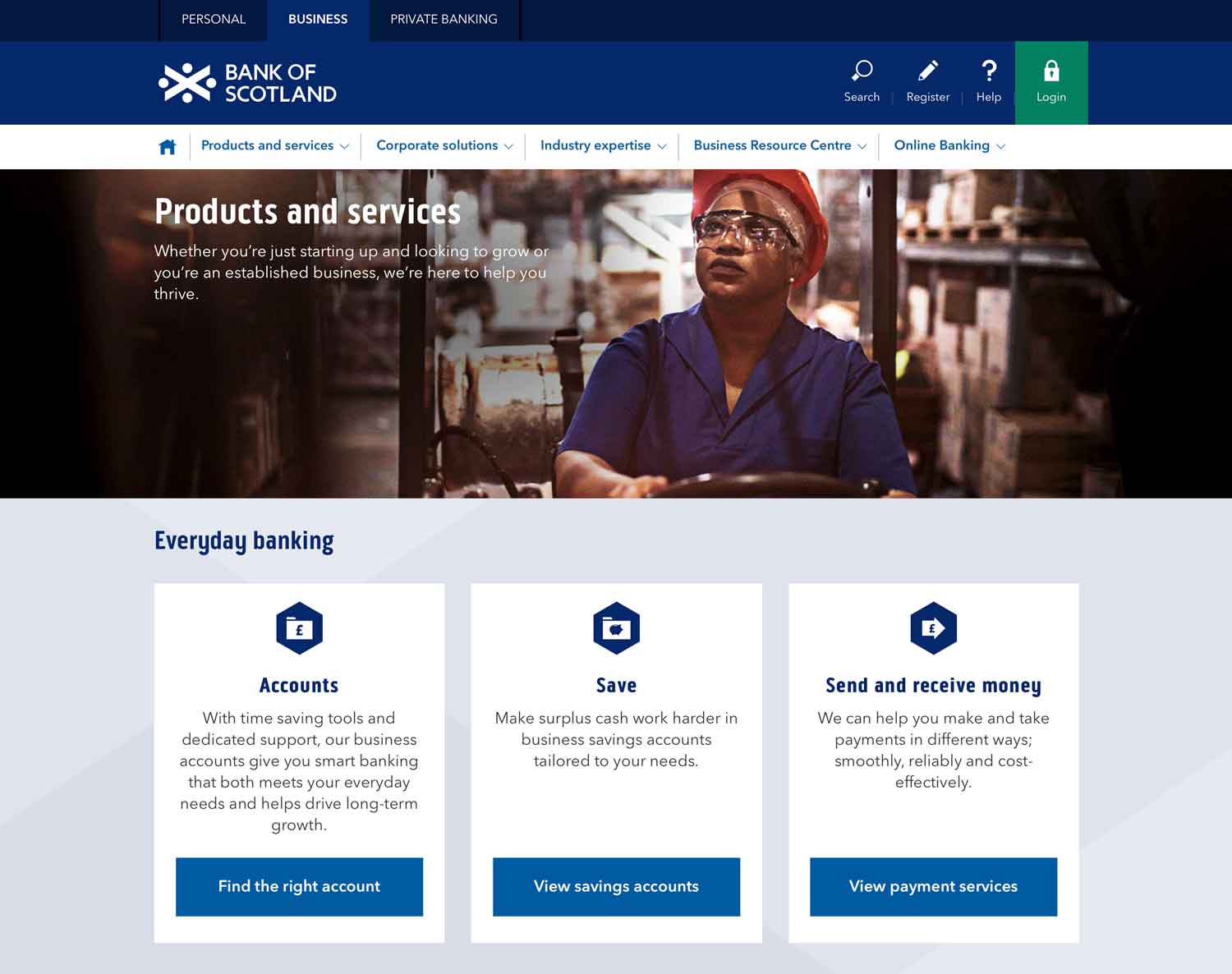

Bank of Scotland business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Bank of Scotland at a glance

- Bank of Scotland business finance and loans

- Bank of Scotland reviews

- Bank of Scotland business eligibility criteria

- Bank of Scotland business finance alternatives

- Bank of Scotland additional considerations

- FAQ

Pros and cons of Bank of Scotland business banking services

| Pros of Bank of Scotland | Cons of Bank of Scotland |

|---|---|

| ✓ Comparatively affordable monthly fees | ✗ Branches are only located in Scotland |

| ✓ Wide range of products | ✗ Poor to middling online reviews |

| ✓ FSCS protected | ✗ Virtually identical services to Lloyds |

Business current accounts

Bank of Scotland offers two bank accounts for sole traders and SMEs:

Bank of Scotland business customers can also enjoy three months of the bank’s in-house accounting software free of charge, charged at £5 per month after this trial expires.

Small Businesses and Start-Ups account

Designed for businesses where there is a sole trader or the only director of a limited company, with an annual turnover below £3,000,000, this account is free for 12 months and then costs £8.50 per month to run. Automated electronic transfers in and out are free of charge, but fees will apply to cash or cheque transactions.

Larger Business account

Businesses with an annual turnover above £3,000,000 need this account, which comes with a dedicated relationship manager. Opt for an Electronic Business Tariff for £20 per month and you will not accrue any transaction charges beyond your monthly fee unless you handle cash or cheques. Alternatively, opt for the Business Extra Tariff for £15 per month and pay 37p for every electronic transaction in or out of your account.

Business overdrafts

Bank of Scotland offers business overdraft facilities between £500 and £25,000. Interest rates will vary according to your personal circumstances.

Business savings accounts

Bank of Scotland offers three savings accounts to business customers:

Instant Access Account

Save between £1 and £5,000,000, earning interest daily at an AER of around 0.80% and accessing your money at any time.

Notice Accounts

Deposit a minimum of £10,000 and withdraw your funds with 32 days’ notice or 95 days’ notice (this option is only available to businesses with a turnover above £3,000,000.) Bank of Scotland will assign a fixed interest rate for your deposit upon application.

Fixed Term Deposit

Deposit a minimum of £10,000 and set a fixed term for the savings bond to run, from one day to two years. Bank of Scotland will assign a fixed interest rate and pay this upon the maturation of the savings bond.

Bank of Scotland at a glance

| Phone number | 0345 721 3141 |

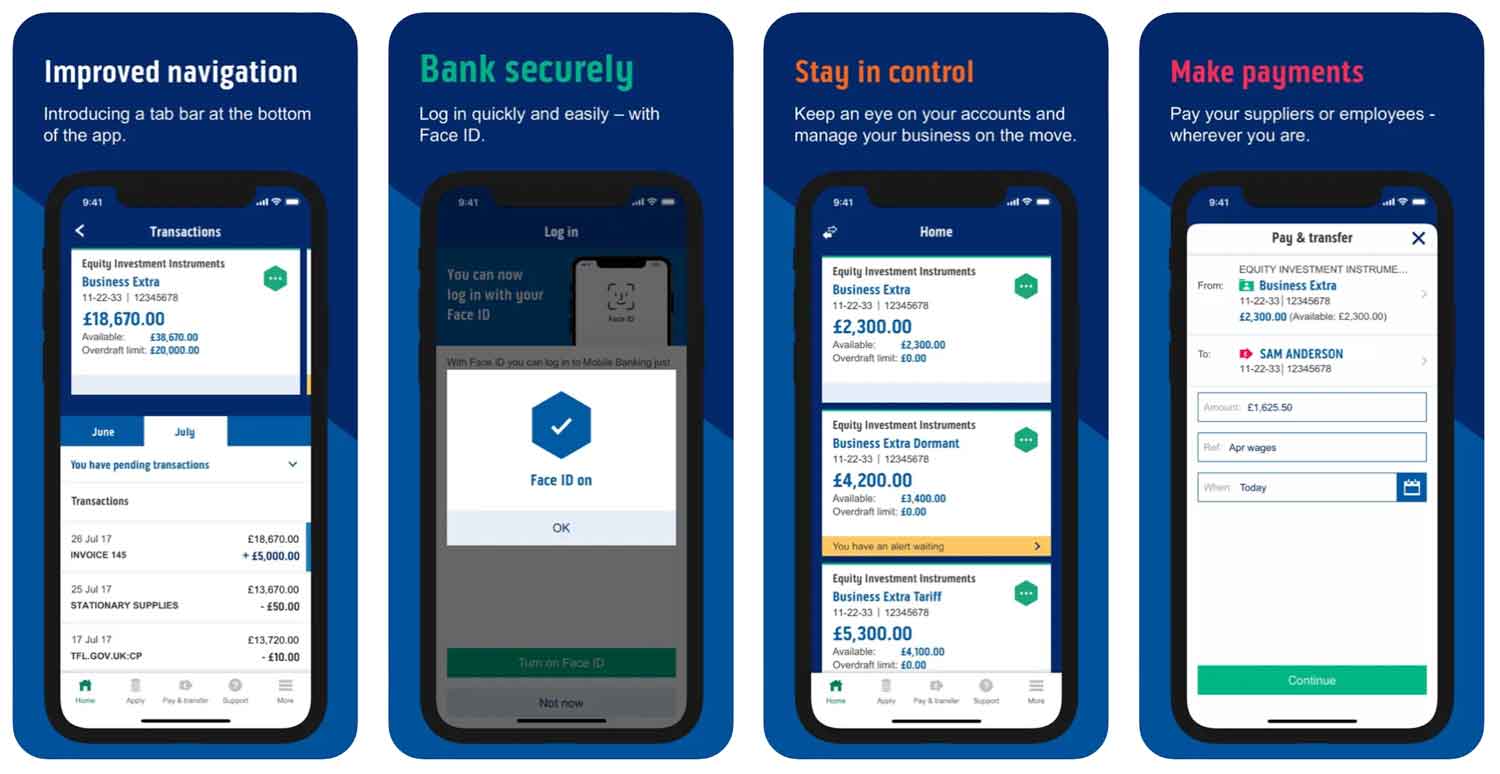

| App downloads | iOS; Android |

| Website | www.business.bankofscotland.co.uk |

| Number of branches | 130, all in Scotland |

| FSCS protected? | Yes |

| Founded | 1695, Edinburgh |

Bank of Scotland business finance and loans

Bank of Scotland offers numerous additional financial products for business customers:

- Business credit card

- Business loans

- Asset finance

- Invoice finance

- Public liability insurance

- Professional indemnity insurance

Business credit card

Bank of Scotland offers a business credit card, with a maximum credit limit of £25,000 and a representative APR of 15.95%. You can also apply for a charge card with a maximum limit of £1,000, the balance of which is to be repaid in full each month in exchange for zero interest.

Business loans

Apply for a business loan of up to £25,000 on a fixed or variable interest rate (representative APR 11.2%,) or discuss options for a larger loan. This borrowing can be repaid for up to 25 years.

Asset finance

Borrow from the Bank of Scotland to finance the purchase of a major asset and take ownership once the debt is settled, or arrange for Bank of Scotland to purchase the asset and lease it from them for as long as required. See asset finance.

Invoice finance

Release up to 90% of the value of an unpaid invoice to improve business cash flow and pass credit control to Bank of Scotland, who will claim the payment and submit the remaining balance after taking a handling fee. See invoice factoring.

Public liability insurance

An insurance policy to protect sole traders from legal action in event of accident or injury to a client or customer.

Professional indemnity insurance

Protect your business from legal claims for compensation if a client or customer loses money after following your advice or using your service.

Bank of Scotland reviews

What are other business banking customers saying about Bank of Scotland?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 1.5/5 | 823 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 2.61/5 | 16 |

| Which? | 3.5/5 | 1 |

| Average score | 2.53/5 | 840 |

Bank of Scotland business eligibility criteria

If you have a clean credit history, do not trade in an illegal or high risk business sector, are aged 18 or over, and provide the appropriate proof of your identity and business standing, there is no reason why you would be refused a Bank of Scotland account. You do not need to be based north of Berwick-upon-Tweed to use the Bank of Scotland, though it may be beneficial to do so.

Bank of Scotland business finance alternatives

As we have discussed, the products offered by Bank of Scotland are virtually identical to those of Lloyds. This makes the latter arguably a more sensible option for anybody based outside of Scotland, as you’ll enjoy greater access to branch support. Other high street banks will also provide similar services, though not all are as cost-effective as Bank of Scotland.

Bank of Scotland additional considerations

A recent news story surrounding the Bank of Scotland suggests that this bank takes security of customers seriously, but may raise eyebrows about how the branch staff managed the situation in hand.

FAQ

Yes, Bank of Scotland is a proper bank. It is the oldest bank in Scotland and has been operating since 1695. It has a long history of providing banking services to customers throughout the UK and around the world. The bank offers an extensive range of financial products and services, including current accounts, savings accounts, mortgages, loans, investment and insurance products, among many other services. Bank of Scotland is also a member of the Financial Services Compensation Scheme (FSCS), which means customers can be reimbursed up to £85,000 in case of any financial losses due to the bank’s failure.

Opening a business account at Bank of Scotland is relatively straightforward. You just need to provide some basic details about your business, such as the type of industry you’re in and the legal structure of the company. Then, you’ll be asked to provide documents that will prove ownership, such as Articles of Association or Certificate of Incorporation. Once these documents have been provided, you can complete the business account application online or in-branch. The bank will then conduct a credit check and may request additional information or documents from you before your business account is approved. Once approved, you’ll be able to access your new Bank of Scotland business account and start using its many features.

Bank of Scotland charges a variety of fees for its services, including transaction fees on current accounts, overdrafts, and business loans. The bank also charges an annual fee on certain savings accounts, as well as international money transfer fees. Other services may have additional associated costs, so it is important to read Bank of Scotland’s terms and conditions before using its services. To find out more about fees and charges, visit Bank of Scotland’s website.

A Bank of Scotland business account is suitable for all types of businesses, including sole traders, limited companies, partnerships, charities and non-profit organisations. Having a business bank account is important as it allows businesses to manage their finances more efficiently and securely. Businesses can benefit from Bank of Scotland’s range of products, such as its current accounts, savings accounts, loans and mortgages.

Bank of Scotland accepts a variety of payment methods, including Visa and Mastercard credit/debit cards, direct debits, standing orders, and bank transfers. The bank also offers contactless payments, Apple Pay and Google Pay for customers who want to make payments quickly and securely.