Despite the name, Card One Money is not a credit card service but a challenger bank current account service. The biggest selling point of Card One Money is that this account does not require any credit checks, so a poor credit history does not need to hold you back.

However, this flexibility comes at a price – this is one of the more expensive current accounts to run online, with a £55 application fee and a £12.50 monthly fee. Electronic transfers also take 24 hours unless you are willing to pay a £7.50 fee, while funds intended for spending must be transferred to a prepaid expense card rather than an active debit card. This makes Card One Money an account accessible to all but very limited in practice.

Featured pro tools

Card One Money business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Card One Money at a glance

- Other business finance products

- Card One Money reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Card One Money for business services

| Pros | Cons |

|---|---|

| ✓ No credit checks | ✗ £55 application fee and £12.50 monthly charge |

| ✓ Accounts usually opened instantly | ✗ Free electronic transfers take 24 hours |

| ✓ UK-based customer support | ✗ Not FSCS protected |

| ✓ Manage invoicing within the app | ✗ No debit card – just a prepaid expense card |

Business current accounts

Pay a £55 application fee and a £12.50 monthly charge, and you will have access to a business account. If your business has a turnover above £2,000,000 per year you will need to pay more (fees will be discussed upon application,) but to be blunt, if you are making that much this is not the bank for you.

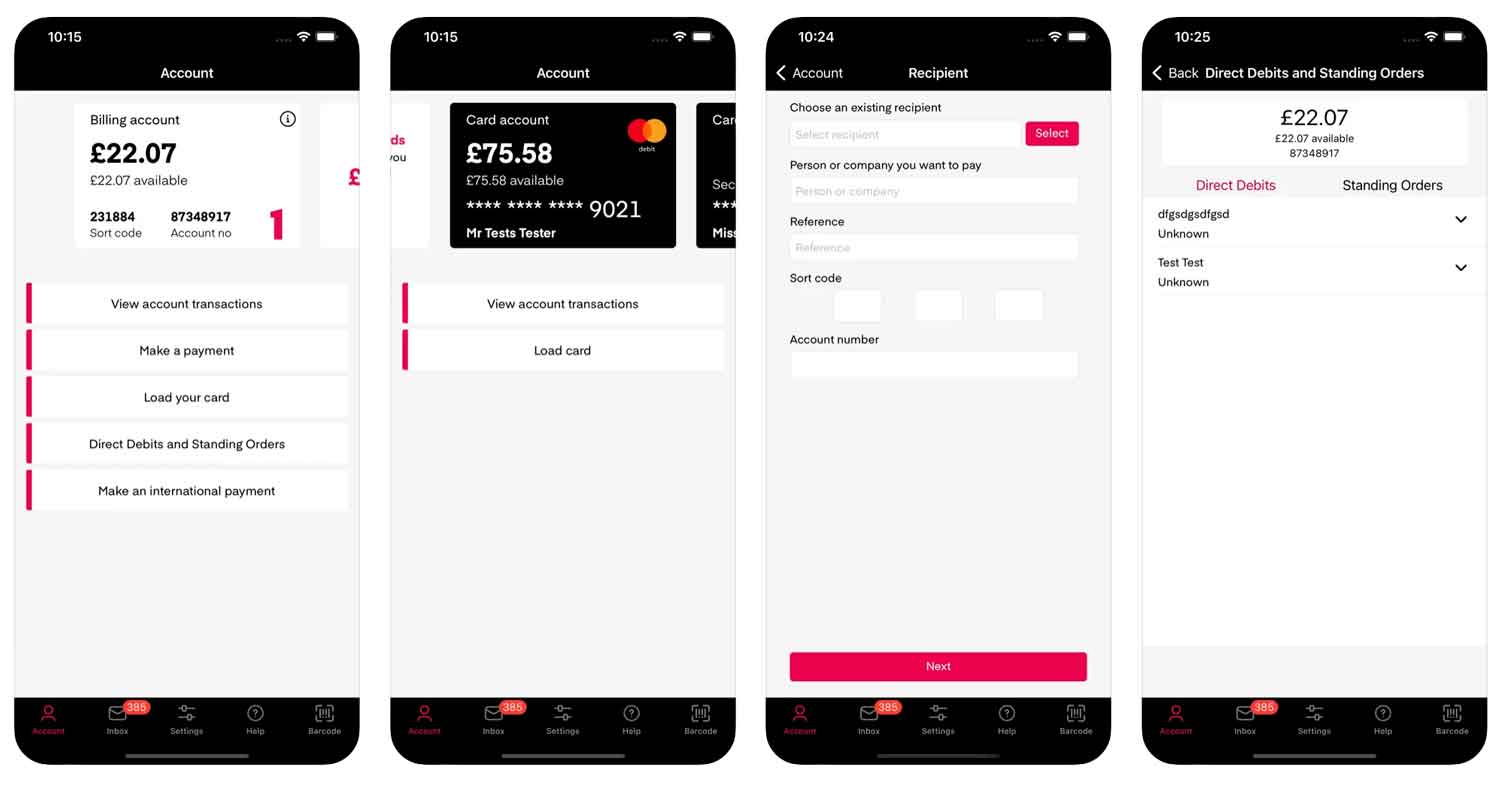

You will not need to undertake a credit check upon opening a Card One Money account, and you will be provided with up to five prepaid MasterCard expense cards that your available balance can be transferred to for general spending. Cheques can be paid into a branch of Barclays, or cash can be withdrawn from this expense card in exchange for a £1.50 fee.

Be aware that free electronic transfers take 24 hours to process with Card One Money. If you need to move money around faster, you must pay a £7.50 fee. This means that you should probably only really consider Card One Money for your business needs if you are keen to avoid credit checks when looking to open an account.

Business overdrafts

✗ Not available through Card One Money. See best business overdrafts.

Business savings accounts

✗ Not available through Card One Money. See best business savings accounts.

Card One Money at a glance

| Phone number | 0345 241 6775 |

| App downloads | iOS; Android |

| Website | www.cardonemoney.com/business/business-account.html |

| Number of branches | N/A |

| FSCS protected? | No |

| Founded | 2007 |

Other business finance products

✗ Card One Money does not provide any additional services beyond those we have discussed.

Card One Money reviews

What are other business banking customers saying about Card One Money?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 4.4/5 | 1053 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 5/5 | 5 |

| Which? | Not reviewed | N/A |

| Average score | 4.7/5 | 1058 |

Business eligibility criteria

As you have probably gathered Card One Money is not particularly fussy about who applies for a business account. The lack of credit checks means that, assuming you pay the £55 application fee and provide proof of your identity, you should have an account up and running within minutes.

Business finance alternatives

Cashplus is probably the closest rival to Card One Money, as this is another challenger bank that does not run credit checks on applicants. The fees are also comparable with this option, so it largely comes down to personal choice.

Additional considerations

Although Card One Money is regulated, it is not a bank. This means you will not be afforded the same protections as you would by a more traditional provider.

FAQ

No. Card One Money is not a bank, but rather a payment card provider and digital banking app. The Card One Money app provides customers with an alternative to traditional banking by providing an easier way to manage their money without having a physical bank account. Customers can add funds and make payments directly from the app using their existing debit or credit cards. The app also allows customers to easily access their account information, make transfers and set up direct debits.

You can open a Card One Money business account online by visiting the Card One Money website. You will need to provide some basic information such as your name, address and contact details before you can create an account. Once your account has been created, you will be able to access all of the features available on the app including transfers, payments and direct debits.

Yes, Card One Money is a secure digital banking app backed by advanced encryption technologies and industry-leading security protocols. All of the data that customers enter into their accounts is encrypted ensuring that it remains private and secure.

Card One Money does not charge any fees for using its services or products. However, customers may be subject to charges from their existing banks when using Card One Money. It is important that customers check the terms and conditions of their bank before using the app.

Card One Money offers a number of services for customers including payments, transfers and direct debits. Customers can also use the app to easily manage their money, track their spending and view account information. The Card One Money app also provides its users with access to exclusive discounts and offers from partnered stores and online retailers.

Card One Money accepts all major debit and credit cards as well as direct bank transfers. Customers can also use the app to make payments using PayPal, Apple Pay and Google Pay. It is important to note that Card One Money does not accept cash payments or cheques. These types of payments must be made through a third-party provider such as PayPal or a bank.

Yes, you can use the Card One Money app for payments and transfers abroad in over 200 countries. However, it is important to check with your existing bank before using the app overseas as you may be subject to additional fees and charges. Additionally, customers should always make sure that their account is sufficiently funded before making any payments. This will help to avoid any unnecessary charges or fees.