Are you considering a Royal Bank of Scotland business account? The Royal Bank of Scotland is a separate entity from the Bank of Scotland, with this high street bank a fixture on high streets all over the UK.

Today, the Royal Bank of Scotland is part of the NatWest Group, which means that its products and services are virtually identical to this one-time competitor.

Featured pro tools

Start-ups will enjoy a longer period of free banking with RBS though, and this bank also provides a lengthy list of lending sources for business customers of all sizes and needs.

All major banks come with their pros and cons, but despite some historical concerns about this institution’s conduct, Royal Bank of Scotland has to be considered among the most business-friendly options on the high street.

Royal Bank of Scotland business banking services

- Pros and cons

- Business current accounts

- Business overdrafts

- Business savings accounts

- Royal Bank of Scotland at a glance

- Royal Bank of Scotland business loans and finance

- Royal Bank of Scotland reviews

- Business eligibility criteria

- Business finance alternatives

- Additional considerations

- FAQ

Pros and cons of Royal Bank of Scotland for business services

| Pros of Royal Bank of Scotland | Cons of Royal Bank of Scotland |

|---|---|

| ✓ Start-ups bank free for 24 months | ✗ Many branches are closing |

| ✓ No monthly account fees | ✗ Microtransaction fees apply |

| ✓ Lots of lending streams are available | ✗ Mixed online reviews |

| ✓ FSCS protected | ✗ Savings interest is better elsewhere |

Business current accounts

Royal Bank of Scotland offers two business accounts, both of which offer free access to the HMRC-approved bookkeeping software FreeAgent and will not charge a monthly account fee.

A business that has been trading for under a year and has an annual turnover below £1,000,000 can apply for a Start-up Account, which offers 24 months of free banking. Anybody else will need to apply directly for a generic Business Account with no free period.

Royal Bank of Scotland business accounts also accrue microtransaction charges once you are outside a free billing period. These break down as follows.

| Type of transaction | Fee or charge |

|---|---|

| Automated credits and debits | 35p per transaction |

| Cheque credits | 70p |

| Cheque debits | 70p |

| Cash paid in or out | 70p per £100 |

Business overdrafts

Royal Bank of Scotland offers business overdrafts up to £50,000. Interest rates and set-up fees will be discussed upon a successful application, though expect an interest rate of around 13.65%.

Business savings accounts

Royal Bank of Scotland offers three choices of savings account to business customers:

Business Reserve

An instant access account with no minimum or maximum balance. Interest is calculated daily and paid on the last trading day of every calendar month. Balances below £10,000 accrue interest at an AER of 1%, while balances over £10,000 gain interest at an AER of 1.26%.

Treasury Reserve

Pay savings into account and earn interest daily based on the national market – interest rates will be discussed and agreed upon application. These will be fixed savings bonds, so you will not be able to access funds until maturity.

If you wish to secure your funds for six days or less, the minimum deposit is £500,000. This drops to £250,000 if you save for up to 27 days, and £10,000 if you enter a bond for longer than this.

Liquidity Manager

A simpler savings account with no minimum balance. Save any sum and give 35 days’ notice before making a withdrawal to earn interest at an AER of 1.61% – calculated daily and paid at the end of each month – or provide 95 days’ notice for an AER of 1.97%.

Royal Bank of Scotland at a glance

| Phone number | 0345 724 2424 |

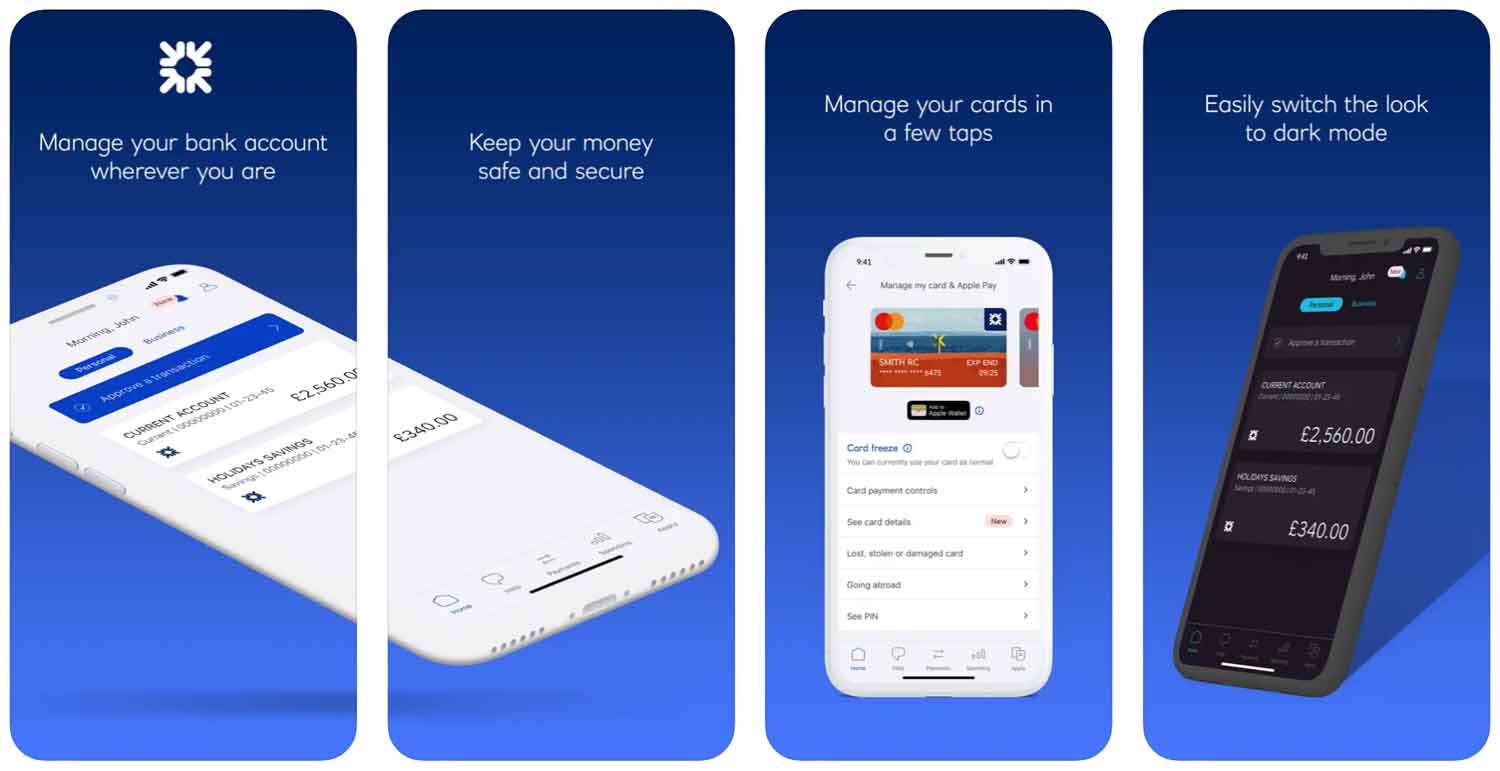

| App downloads | iOS; Android |

| Website | www.rbs.co.uk/business |

| Number of branches | 700, most of which are in Scotland |

| FSCS protected? | Yes |

| Founded | 1727 |

Royal Bank of Scotland business loans and finance

In addition to business current accounts and savings accounts, Royal Bank of Scotland offers the following products to business customers:

- Business Credit Card

- Business Credit Card Plus

- OneCard

- Small Business Loan

- Fixed Interest Rate Loan

- Variable Rate Loan

- Invoice Finance

- Asset Finance

- Green Loans

- Commercial Mortgage

- Real Estate Finance

Business Credit Card

A standard Royal Bank of Scotland business credit card for SMEs and sole traders with an annual turnover below £2,000,000 per year, charged at £30 per year (free for 12 months and waived if you spend more than £6,000 in a year) with a representative APR of 24.3%.

Business Credit Card Plus

A Royal Bank of Scotland business credit card for SMEs and sole traders with an annual turnover above £6,500,000 per year, charged at £70 per year with a representative APR of 29%. This credit card accrues cashback on spending, capped at £600 per year.

OneCard

For SMEs and sole traders with an annual turnover above £2,000,000 per year, charged at £45 per year with monthly interest of 1.6%. Spending limits can be set on this card, and holders can use their OneCard to add funds to a Royal Bank of Scotland business bank account as well as spend.

Small Business Loan

Borrow between £1,000 and £50,000 on a fixed interest rate for up to seven years. Representative APR is 12.35%. See business loans.

Fixed Interest Rate Loan

If you need larger sums, apply for a loan between £25,001 and £10,000,000, to be repaid over 3, 5, 7, 10, 15, 20, or 25 years. These loans may need to be secured against an asset. There will be no early exit fees if you wish to repay your loan early.

Variable Rate Loan

Borrow any sum above £1,000 with no upper limit, with repayments based on the Royal Bank of Scotland base rate of interest. Repayment holidays are available, and there will be no early exit fees if you need to settle your balance early.

Invoice Finance

Release up to 90% of the value of an outstanding invoice, receiving the remaining balance due – minus a fee – from Royal Bank of Scotland once your client or customer settles their account. See invoice factoring.

Asset Finance

Turn to Royal Bank of Scotland via Lombard to finance a major asset investment for your business, leasing the asset with the option to purchase at the end of a hire term, or to gain a share of any resale value if the asset is no longer required. See asset finance.

Green Loans

Borrow from £25,001 at a fixed or variable interest rate to invest in ecologically friendly, sustainable business practices.

Commercial Mortgage

Purchase a trading premises for your business by taking out a mortgage for up to 25 years. See commercial mortgages.

Real Estate Finance

Borrow upward of £50,000 to refurbish or develop investment properties under your business umbrella, repayable for up to 20 years.

Royal Bank of Scotland reviews

What are other business banking customers saying about Royal Bank of Scotland?

| Review platform | Score | Number of votes |

|---|---|---|

| TrustPilot | 1.3/5 | 718 |

| Feefo | Not reviewed | N/A |

| Reviews.co.uk | Not reviewed | N/A |

| Smart Money People | 4.07/5 | 504 |

| Which? | 2.6/5 | 1 |

| Average score | 2.657/5 | 1,223 |

Business eligibility criteria

Royal Bank of Scotland will ask for proof of your identity and trading address when applying for a business account, and will ask some questions to ensure that your business model is not deemed too risky.

If you’re interested in opening a Royal Bank of Scotland business bank account, it’s best to do so in person at a branch – online applications can take several weeks to complete.

Business finance alternatives

Royal Bank of Scotland products are virtually identical to those of NatWest as these two high street behemoths are part of the same parent group, making this seem like the most obvious alternative.

Equally, businesses in Northern Ireland could approach Ulster Bank, which is also part of the NatWest Group family. Barclays and Lloyds round out the “big four” high street banks, or you may wish to consider a smaller alternative like Metro Bank or TSB.

Additional considerations

The Royal Bank of Scotland make some unwelcome headlines back in 2016, when the bank was accused of nefarious decision-making that primed various SMEs for failure so they could be asset-stripped. Similar claims have not arisen since, but this report will still leave a bad taste in many mouths.

FAQ

Yes, the Royal Bank of Scotland (RBS) is a legitimate bank, and is one of the oldest banking institutions in the world. The RBS has been providing financial services to customers since 1727 and is regulated by the Financial Conduct Authority (FCA). With its headquarters in Edinburgh, Scotland, it operates through numerous branches, subsidiaries and international offices across the UK and worldwide. The Bank offers a full range of retail banking, commercial banking, private banking and wealth management services for individuals, businesses and corporations.

Opening a business account with the RBS is relatively straightforward. Firstly, you will need to apply for an account and provide details about your business. This includes information such as how long it has been established and other financial records. Once your application is received, the bank will process it and contact you for further documents if necessary. After all requirements are fulfilled, your business account will be approved and you can start using the banking services. Additionally, you will also have access to a range of online tools to help you manage your finances efficiently.

The fees charged by the RBS depend on the type of account you open. Generally, there are two types of accounts – a business current account and a business savings account. For both types of accounts, there may be a monthly fee for services such as online banking, overdrafts, or other transactions.

The RBS offers a number of services to businesses, including lending, payment processing, credit cards, international payments and currency exchange. Additionally, the bank provides various online tools that businesses can use to manage their finances more efficiently. These tools include budgeting tools, real-time financial reporting and analysis and 24/7 customer support.

The Royal Bank of Scotland accepts payments in a variety of forms, including BACS, CHAPS, Faster Payments and Direct Debits. Additionally, the bank also accepts debit cards, credit cards and online payments through its secure payment gateway. All transactions are subject to the bank’s security protocols to ensure data protection and safety.